Your Canada the canadian film or video production tax credit images are ready. Canada the canadian film or video production tax credit are a topic that is being searched for and liked by netizens today. You can Download the Canada the canadian film or video production tax credit files here. Get all free images.

If you’re searching for canada the canadian film or video production tax credit images information related to the canada the canadian film or video production tax credit topic, you have pay a visit to the right site. Our site always gives you hints for viewing the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

Canada The Canadian Film Or Video Production Tax Credit. Ad Videoproduktion für Ihr Unternehmen. Produced with the participation of the canada media fund. Canadian Film or Video Production Tax Credit Program CPTC - Certified Productions These lists provide the following information on productions for which a Canadian film or video production Part A certificate defined in subsection 1254 1 of the Income Tax Act was issued. Qualified labour expenditures are limited to 60 of the amount by which the cost of the production exceeds assistance.

Pin On Quebec Canada From pinterest.com

Pin On Quebec Canada From pinterest.com

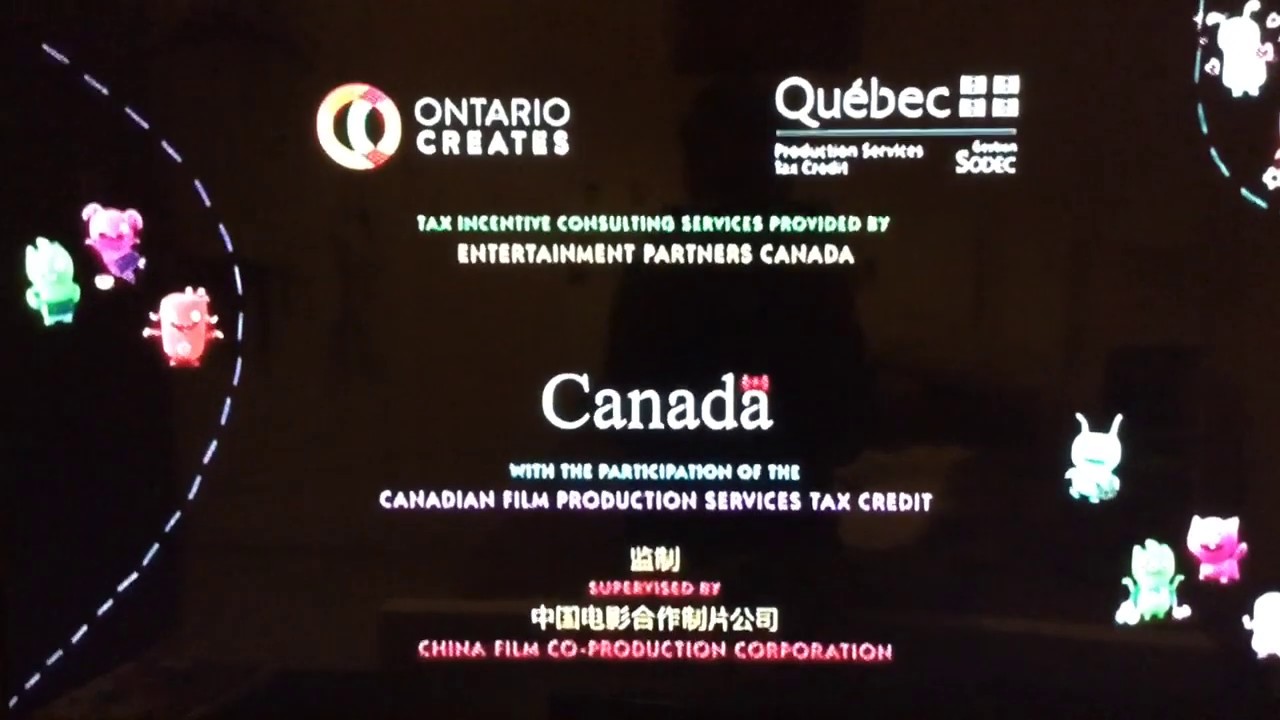

On many shows the phrase The Canadian Film or Video Production Tax Credit appears below the logo. Filmed in Queensland Australia With The Assistance of The Queensland Government. To be eligible for the CPTC the applicant must be a Canadian-owned taxable corporation that is primarily in the business of Canadian film or video production. The Canada Revenue Agency and the Department of Canadian Heritage through the Canadian Audio-Visual Certification Office jointly administer this tax credit. Canadian home video rating system. With Canadian Film or Video Production Tax Credit CPTC Sorted by Popularity Ascending 1.

Produced with the participation of the canada media fund.

Produced with the participation of the canada media fund. Qualified labour expenditures are limited to 60 of the amount by which the cost of the production exceeds assistance. Canadian home video rating system. 2 Cartoon Network Studios. The CPTC program is jointly administered. Canada the canadian film or video production tax credit logo png.

Source: pinterest.com

Source: pinterest.com

Produced with the participation of the canada media fund. Darstellung Ihrer Firma Leistungen und Produkte. The Canadian Film or Video Production Tax Credit CPTC provides eligible productions with a fully refundable tax credit available at a rate of 25 per cent of the qualified labour expenditure. Production companies with permanent operations in British Columbia receive a 28 refundable tax credit. Ad Videoproduktion für Ihr Unternehmen.

Source: pinterest.com

Source: pinterest.com

Canada the canadian film or video production tax credit logo png. If eligible for the CPTC your corporation can get a refundable tax. The CPTC program is jointly administered. Must primarily be a Canadian film or video production business with a permanent establishment in Canada throughout the year. Darstellung Ihrer Firma Leistungen und Produkte.

Source: pinterest.com

Source: pinterest.com

Production companies with permanent operations in British Columbia receive a 28 refundable tax credit. Federal Tax Credits Canadian Film or Video Production Tax Credit CPTC The CPTC is 25 of qualified labour expenditures for the year in respect of the production. Canadian Film or Video Production Tax Credit To be eligible for the Canadian Film or Video Production Tax Credit CPTC the applicant must be a Canadian-owned taxable corporation that is primarily in the business of Canadian film or video production. To be eligible for the Canadian film or video production tax credit your production must first be certified by the Canadian Audio-Visual Certification Office as a Canadian film or video production. Canadian Film or Video Production Tax Credit CPTC Federal.

Source: pinterest.com

Source: pinterest.com

The film or video production services tax credit pstc provides eligible production corporations with a tax credit at a rate of 16 per cent of the qualified canadian labour expenditures incurred in respect of an accredited production. It is available only to a qualified Canadian-owned. Ad Videoproduktion für Ihr Unternehmen. With the Participation of the Canadian Film or Video Production Services Tax Credit. The shows ending theme or silence.

Source: pinterest.com

Source: pinterest.com

Zahlreiche Referenzen von bekannten internationalen Unternehmen. This film has been produced and distributed with brazilian public funds operated or managed by the. On many shows the phrase The Canadian Film or Video Production Tax Credit appears below the logo. The Canadian Film or Video Production Tax Credit CPTC is a refundable corporate tax credit designed to encourage the creation of Canadian film and television programming and the development of an active domestic independent production sector in Canada. What is the Canadian Film or Video Production Tax Credit.

Source: pinterest.com

Source: pinterest.com

Zahlreiche Referenzen von bekannten internationalen Unternehmen. This film has been produced and distributed with brazilian public funds operated or managed by the. On season 3 episodes of Miss Spiders Sunny Patch Friends the phrase is shortened to The Canadian Film or Video Tax Credit. A New Legacy 2021 A rogue artificial intelligence kidnaps the son of famed basketball player LeBron James who then has to work. It is available only to a qualified Canadian-owned.

Source: pinterest.com

Source: pinterest.com

British Columbia Production Services Tax Credit Provincial. Ontario Film and Television Tax Credit OFTTC produced with the assistance of as Government of Ontario - Ontario Film and Television Tax Credit Distributors. Filmed in Queensland Australia With The Assistance of The Queensland Government. Darstellung Ihrer Firma Leistungen und Produkte. Tax Consulting Services - Entertainment Partners Canada.

Source: pinterest.com

Source: pinterest.com

Canada the canadian film or video production tax credit logo png. A credit is available equal to 25 percent of qualified salaries and wages in respect of Canadian residents now limited to 60 percent of the total certified film cost net of assistance hence resulting in a tax credit of a maximum of 15 percent of the total certified film cost. The film or video production services tax credit pstc provides eligible production corporations with a tax credit at a rate of 16 per cent of the qualified canadian labour expenditures incurred in respect of an accredited production. Darstellung Ihrer Firma Leistungen und Produkte. Filmed in Queensland Australia With The Assistance of The Queensland Government.

Source: pinterest.com

Source: pinterest.com

The title of the production for which the certificate was issued and. 2 Cartoon Network Studios. Federal Tax Credits Canadian Film or Video Production Tax Credit CPTC The CPTC is 25 of qualified labour expenditures for the year in respect of the production. Must primarily be a Canadian film or video production business with a permanent establishment in Canada throughout the year. Momentum Pictures 2003 UK theatrical Odeon Films 2003 Canada theatrical Alliance Atlantis Home Video 2004 Canada VHS DEJ Productions 2004 USA VHS Dimension Pictures 2019 India all.

Source: pinterest.com

Source: pinterest.com

Canadian Film or Video Production Tax Credit Program CPTC - Certified Productions These lists provide the following information on productions for which a Canadian film or video production Part A certificate defined in subsection 1254 1 of the Income Tax Act was issued. Jointly administered by the Canadian Audio-Visual Certification Office CAVCO and the Canada Revenue Agency the CPTC encourages the creation of Canadian. British Columbia Production Services Tax Credit Provincial. Federal Tax Credits Canadian Film or Video Production Tax Credit CPTC The CPTC is 25 of qualified labour expenditures for the year in respect of the production. The title of the production for which the certificate was issued and.

Source: pinterest.com

Source: pinterest.com

Canadian Film or Video Production Tax Credit CPTC. Qualified labour expenditures are limited to 60 of the amount by which the cost of the production exceeds assistance. Tax Consulting Services - Entertainment Partners Canada. Darstellung Ihrer Firma Leistungen und Produkte. With Canadian Film or Video Production Tax Credit CPTC Sorted by Popularity Ascending 1.

Source: pinterest.com

Source: pinterest.com

To be eligible for the Canadian film or video production tax credit your production must first be certified by the Canadian Audio-Visual Certification Office as a Canadian film or video production. The Canadian film or video production tax credit CPTC encourages both production in Canada and Canadian programming. Momentum Pictures 2003 UK theatrical Odeon Films 2003 Canada theatrical Alliance Atlantis Home Video 2004 Canada VHS DEJ Productions 2004 USA VHS Dimension Pictures 2019 India all. Canadian Film or Video Production Tax Credit Program CPTC - Certified Productions These lists provide the following information on productions for which a Canadian film or video production Part A certificate defined in subsection 1254 1 of the Income Tax Act was issued. Ad Videoproduktion für Ihr Unternehmen.

Source: pinterest.com

Source: pinterest.com

Just the Canada print logo. Canadian Film or Video Production Tax Credit To be eligible for the Canadian Film or Video Production Tax Credit CPTC the applicant must be a Canadian-owned taxable corporation that is primarily in the business of Canadian film or video production. To be eligible for the CPTC the applicant must be a Canadian-owned taxable corporation that is primarily in the business of Canadian film or video production. The Canadian Film or Video Production Tax Credit CPTC provides eligible productions with a fully refundable tax credit available at a rate of 25 per cent of the qualified labour expenditure. Canadian Film or Video Production Tax Credit Program CPTC - Certified Productions These lists provide the following information on productions for which a Canadian film or video production Part A certificate defined in subsection 1254 1 of the Income Tax Act was issued.

Source: pinterest.com

Source: pinterest.com

What is the Canadian Film or Video Production Tax Credit. Community content is available under CC-BY-SA unless otherwise noted. With the Participation of the Province of British Columbia Production Services Tax Credit. Ad Videoproduktion für Ihr Unternehmen. To be eligible for the CPTC the applicant must be a Canadian-owned taxable corporation that is primarily in the business of Canadian film or video production.

Source: pinterest.com

Source: pinterest.com

Canadian Film or Video Production Tax Credit CPTC. The Canadian film or video production tax credit CPTC encourages both production in Canada and Canadian programming. Federal Tax Credits Canadian Film or Video Production Tax Credit CPTC The CPTC is 25 of qualified labour expenditures for the year in respect of the production. Canadian Film or Video Production Tax Credit. Tax Consulting Services - Entertainment Partners Canada.

Source: pinterest.com

Source: pinterest.com

With the Participation of the Canadian Film or Video Production Services Tax Credit. Canadian Film or Video Production Tax Credit Program CPTC - Certified Productions These lists provide the following information on productions for which a Canadian film or video production Part A certificate defined in subsection 1254 1 of the Income Tax Act was issued. Canadian Film or Video Production Tax Credit. To be eligible your clients company should own the copyright or contract the rights directly from the current copyright. A credit is available equal to 25 percent of qualified salaries and wages in respect of Canadian residents now limited to 60 percent of the total certified film cost net of assistance hence resulting in a tax credit of a maximum of 15 percent of the total certified film cost.

Source: pinterest.com

Source: pinterest.com

Its available to both Canadian and foreign companies that do 50 of their business permanently in Canada. Ad Videoproduktion für Ihr Unternehmen. The shows ending theme or silence. Canadian Film or Video Production Tax Credit CPTC. Ontario Film and Television Tax Credit OFTTC produced with the assistance of as Government of Ontario - Ontario Film and Television Tax Credit Distributors.

Source: pinterest.com

Source: pinterest.com

To be eligible your clients company should own the copyright or contract the rights directly from the current copyright. If eligible for the CPTC your corporation can get a refundable tax. With the Participation of the Canadian Film or Video Production Services Tax Credit. Canada the canadian film or video production tax credit logo png. Canadian Film or Video Production Tax Credit Program CPTC - Certified Productions These lists provide the following information on productions for which a Canadian film or video production Part A certificate defined in subsection 1254 1 of the Income Tax Act was issued.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title canada the canadian film or video production tax credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.